Long-Term Care Planning (Business Opportunities - Investment)

USNetAds > Business Opportunities > Investment

Item ID 133508260 in Category: Business Opportunities - Investment

Long-Term Care Planning | |

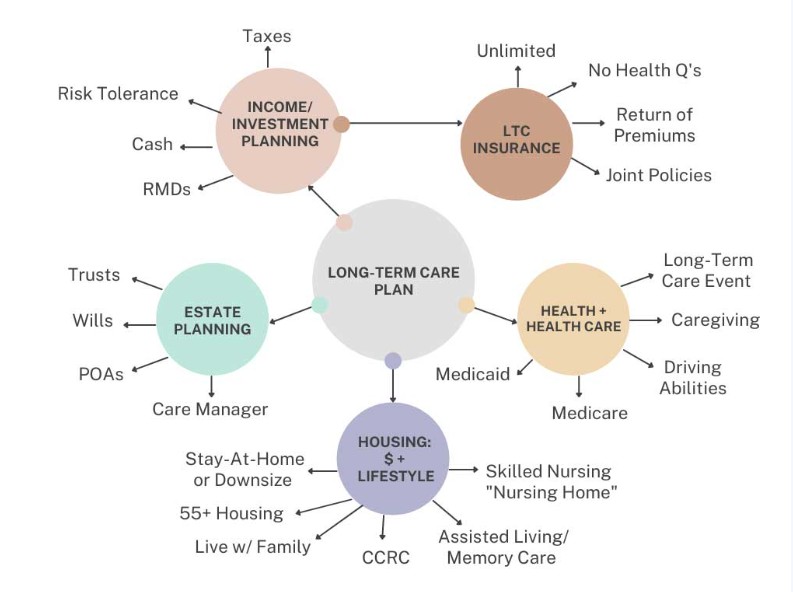

It is reasonable to assume that if you live to 80 or longer you could need care assistance for at least a few years. This will be an increased expense that will affect your income. A Long-Term Care Plan addresses longevity, how you will remain safe at home or at a retirement community, and mitigates the consequences of needing care and paying for it. Often the emotional, physical, and financial consequences are felt most deeply by the caregiver, typically a spouse or adult child. Receiving outside care can help offset these consequences. Many people automatically think planning for long-term care consequences simply means buying insurance. This is not a plan. A long-term care insurance policy could pay for your plan, but it is not the plan. Long-Term Care insurance is just one way to protect your family, income, and lifestyle from a long-term care event and it should be examined. For example, many people are unaware of recent renovations in long-term care insurance options available: Don’t use it? Get your money back. Contract guarantee of no future rate increases. Plans pay ‘cash’ so that you use the money how you see fit. Ultimately, Long-Term Care Planning can be complex and it can take time to understand how the pieces of retirement planning figure in a long-term care event for you and your family.  | |

| Related Link: Click here to visit item owner's website (0 hit) | |

| Target State: South Carolina Target City : Greenville Last Update : Apr 30, 2025 4:26 PM Number of Views: 30 | Item Owner : George Fossing Contact Email: Contact Phone: (None) |

| Friendly reminder: Click here to read some tips. | |

USNetAds > Business Opportunities > Investment

© 2025 USNetAds.com

GetJob.us | CANetAds.com | UKAdsList.com | AUNetAds.com | INNetAds.com | CNNetAds.com | Hot-Web-Ads.com | USAOnlineClassifieds.com

2025-06-16 (0.387 sec)